| Cardholders can avail of 1 complimentary golf game and 1 complimentary golf lesson per month with this card. |

|---|

| Pinnacle card users can enjoy the ‘Buy One Get One’ offer on movie tickets on BookMyShow. |

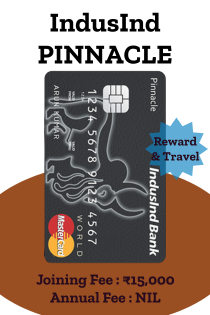

| Joining Fee | ₹ 15000 |

|---|---|

| Annual Fee | NIL |

| Interest on Revolving Credit | 3.83% p.m. | 46% p.a. |

| Late Payment Charges | Up to Rs. 100- Nil, From Rs. 101 to Rs. 500- Rs. 100, From Rs. 501 to Rs. 1,000- Rs. 350, From Rs. 1,001 to Rs. 10,000- Rs. 550, From Rs. 10,001 to Rs. 25,000- Rs. 800, From Rs. 25,001 to Rs. 50,000- Rs. 1,100, Above 50,000- Rs. 1,300 |